The Missing Link in Revenue Cycle Success:

Why Every Medical Practice Needs a Billing Audit in 2025

If there’s one conversation dominating boardrooms, compliance meetings, and physician roundtables right now, it’s this:

“Why are we working harder… yet collecting less?”

Across the U.S., denial rates have climbed to some of the highest levels seen in the last decade. Payers are tightening their rules. Compliance oversight is more aggressive. And the financial margin for error in medical billing has become razor thin.

Yet despite all of this, most practices still operate without a structured medical billing audit—the single most effective tool for uncovering hidden revenue losses and compliance risks.

The surprising truth?

There is almost no comprehensive, practical content online explaining how a medical billing coding audit actually works or why it has become essential in 2025.

So this guide aims to fill that gap with clarity, data, and real-world perspective.

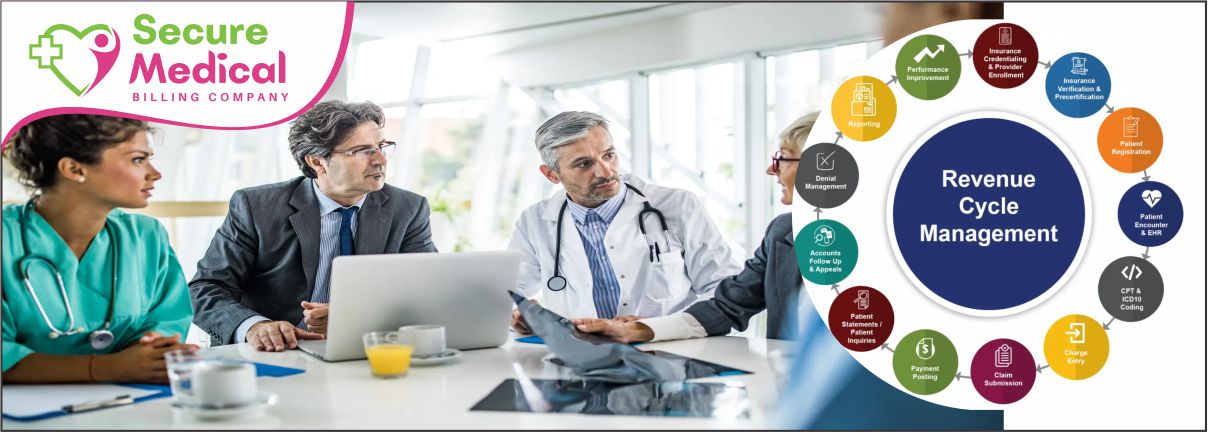

? What a Medical Billing Audit Really Is—Beyond the Buzzword

A medical billing audit isn’t just a check-up. It’s a full diagnostic scan of your revenue cycle, examining everything from the moment a patient is registered to the moment the claim is paid.

A true audit evaluates:

Documentation quality

Coding accuracy (CPT, ICD-10, HCPCS)

Modifier consistency

Charge capture completeness

Claim submission workflow

Denial patterns

Payer-specific billing behavior

AR aging and follow-ups

Compliance adherence

Staff workflow and training gaps

This is where most practices are blindsided:

Revenue doesn’t only disappear due to coding errors. It disappears because of workflow gaps, staff habits, lack of payer-specific updates, sloppy documentation, or simple miscommunication between clinical and billing teams.

An audit exposes all of it—objectively and systematically.

If you want to see what a full audit process looks like, explore:

? https://smbc365.com

? Why Audits Matter More in 2025 Than Any Previous Year

If you're a physician or practice manager, this part will hit home.

1. Payers are far more aggressive now.

Insurers are using advanced algorithms, AI-driven claim screening, and tighter documentation criteria. It’s no longer enough to code “correctly.”

You must code according to payer-specific logic, which changes constantly.

2. Compliance enforcement is at an all-time high.

Telehealth documentation, E/M updates, medical necessity interpretation, and modifier accuracy are under a microscope.

3. Denials aren’t just rising—they’re evolving.

We're seeing new denial categories, especially from Medicare and commercial payers, that didn’t even exist five years ago.

4. Internal workflows haven’t kept up with payer changes.

From front-desk processes to charge entry, small inefficiencies now lead to major financial losses.

5. Underbilling is shockingly common.

Providers often undercode out of fear of audits or uncertainty about documentation standards—losing thousands every month.

This is exactly why searches for medical billing coding audit services and medical billing audit guidance are skyrocketing.

? The Types of Audits Physicians Actually Need (Not the Generic Ones You See Online)

Most articles list “3 types of audits.”

In reality, a modern practice needs targeted audit structures depending on its challenges.

Here are the critical audit types that matter in 2025:

1. Coding & Documentation Audit (High-Demand Keyword: “medical billing coding compliance”)

Evaluates the accuracy and consistency of:

CPT

ICD-10

HCPCS

Modifiers

Clinical documentation

Medical necessity

Payer-specific requirements

Who needs it:

Practices with rising denials, provider coding inconsistencies, EMR template overuse, or multiple specialties.

2. Full Revenue Cycle Audit

A comprehensive review of the entire billing ecosystem from patient registration to payment posting.

Who needs it:

Any practice unsure why revenue isn’t aligning with service volume.

3. Workflow Efficiency Audit (Keyword: “medical billing workflow audit”)

A practical, operations-focused evaluation that identifies inefficiencies in:

Eligibility

Prior authorization

Charge capture

Claim creation

Claim follow-ups

Who needs it:

Practices with staff turnover or inconsistent workflows.

4. Chart Audit (Keyword: “chart audit process medical billing”)

Examines clinical documentation against billed codes—where most legal and financial risks originate.

5. Compliance Audit (Critical Keyword: “medical billing audits for healthcare compliance”)

Focuses on minimizing exposure to:

RAC audits

Insurance audits

Medicare scrutiny

Penalties

Overpayment requests

6. AR & Denial Management Audit

Reviews aging patterns, staff follow-up habits, and payer behavior.

This is often the biggest unlock for recovering stagnant AR.

? What Practices Commonly Discover During Audits (Based on Real Cases)

Over the last few years, SMBC365 has audited clinics, surgery centers, and multi-specialty practices. The patterns are consistent:

The top 10 issues we uncover the most:

Missing or incomplete charges

Modifier mistakes

Downcoding due to documentation fear

Overlooked add-on codes

Incorrect telehealth billing

Eligibility not properly verified

Claims submitted without proper authorization

Repeated payer-template errors

Denials not appealed

Aging AR left untouched for months

Every practice thinks their process is “going fine”

—until they see how much revenue was left uncollected.

Visit https://smbc365.com to understand how these issues are corrected.

? How SMBC365 Conducts a Medical Billing Audit (6-Step Expert Process)

This isn’t a quick review or template-driven process.

It’s a meticulous, data-backed audit by experienced RCM professionals.

Step 1: Intake & Data Gathering

We collect charts, claims, reports, workflow documentation, and billing logs.

Step 2: Coding & Documentation Review

Every CPT, ICD-10, HCPCS, and modifier is analyzed for accuracy, risk, and compliance.

Step 3: Workflow & Operational Assessment

We pinpoint where your internal processes are breaking down.

Step 4: Denial Pattern Mapping

We isolate payer-specific failure points and hidden denial triggers.

Step 5: Revenue Leakage & Risk Report

You receive a detailed, actionable report showing exactly where revenue is being lost.

Step 6: Optimization Plan & Support

We fix issues, train your team, and help you rebuild your revenue cycle with clarity and confidence.

This is where practices typically see the big jump in revenue.

? If You Want Higher Collections in 2025, Start With an Audit

Every practice wants:

? Higher reimbursements

? Lower denials

? More accurate coding

? Clean compliance

? Faster cash flow

? A stable, predictable revenue cycle

A strategic billing audit is the fastest and most reliable way to achieve all of that.

? Explore SMBC365’s Audit & Billing Services:

https://smbc365.com

? FAQ: Clear, Direct Answers for Physicians & Administrators

1. How often should a medical practice perform a billing audit?

Every 6–12 months or anytime you introduce a new provider, EMR, or service line.

2. Can a billing audit really increase revenue?

Yes. Most practices recover 20–40% more revenue simply by correcting hidden issues.

3. Who should conduct a billing audit—internal staff or an external company?

Always an external specialist. Internal teams cannot audit their own work objectively.

4. Does a billing audit protect against payer audits?

Absolutely. It’s one of the strongest layers of protection against RAC, MAC, and commercial audits.

5. Does SMBC365 offer full RCM audits and compliance assessments?

Yes.

Learn more here: https://smbc365.com