The True Cost of In-House Billing:

Why Top US Practices Are Outsourcing in 2025

What if 15% of your monthly revenue simply vanished?

For many US medical practices, that isn't a hypothetical—it's a reality. Recent data shows that denial rates are climbing, with 15-20% of all claims being denied or rejected. Even worse, it's estimated that up to 80% of medical bills in the US contain errors, costing providers billions annually.

As a physician or practice manager, you've always faced a critical decision: manage your billing in-house or partner with a medical billing company.

Many default to an in-house team, believing it offers more control. But in 2025, that "control" is often an illusion that masks massive, hidden costs. This guide breaks down the true financial impact of both models.

The Myth of "Cheaper" In-House Billing

Running an in-house billing department is far more expensive than just the salary of your biller. The true cost is a combination of direct, indirect, and missed-opportunity costs.

1. The "Loaded" Staffing Costs

The salary you pay is just the beginning.

Salaries & Benefits: A single certified biller's salary is a significant expense. A team of billers, coders, and a manager is a massive fixed overhead.

Constant, Expensive Training: Payer rules, coding guidelines (ICD-10, CPT), and compliance laws change quarterly. If your team isn't 100% up-to-date, your denials will skyrocket.

Turnover & Disruption: When your solo biller quits (or just goes on vacation), your entire cash flow stops. The cost of hiring, re-training, and the inevitable errors during the transition can be financially devastating.

2. The Hidden Technology & Infrastructure Tax

Your team is only as good as its tools. This includes fixed annual costs for:

Billing & PM software subscriptions

Clearinghouse fees

Ongoing IT support and hardware

Secure data and network maintenance

3. The Unseen Cost of Inefficiency

This is the single biggest-revenue killer for in-house teams.

Industry Fact: It costs a practice, on average, over $25 to rework a single denied claim. An in-house team struggling to keep up is a drain on profitability.

Your team has to split its time between new claim submissions, payment posting, managing rejections, and working the aging A/R. It's impossible to do it all effectively.

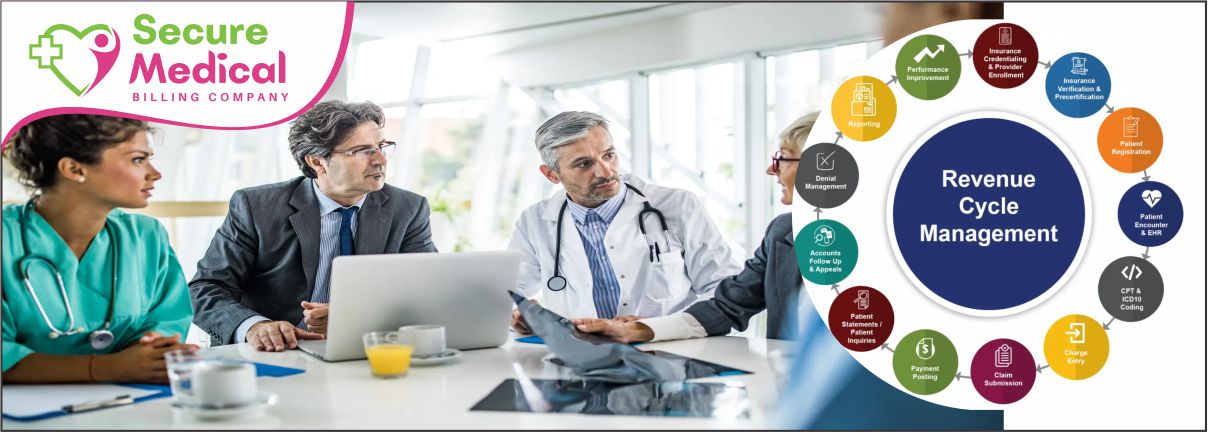

The Financial Power of Outsourcing to an RCM Specialist

Partnering with a dedicated RCM medical billing company isn't "giving up control." It's gaining control over your financials by leveraging expertise and scalable technology.

1. Converting Your Biggest Cost into a Variable Expense

The financial model is instantly smarter.

In-House: You have high fixed costs (salaries, software) regardless of how much you collect.

Outsourced: You have a low variable cost (a small percentage of the revenue we actually collect).

This model aligns our goals completely: If you don't get paid, we don't get paid.

2. Gaining an Entire Expert Team for Less

When you outsource to a firm like SMBC365, you don't just get a biller. You get an entire ecosystem of specialists for less than the price of one in-house employee:

Certified Coders: A dedicated medical coding company ensures you are coding for maximum, compliant reimbursement.

Denial Management Specialists: A team whose only job is to aggressively fight, appeal, and recover revenue from denied and rejected claims.

Credentialing Experts: We handle all provider enrollment and medical credentialing services to ensure your new providers can bill from day one.

Compliance & Audit Team: A qualified billing audit company that constantly audits your accounts to protect you from risk.

3. Measurable, Data-Driven Performance

The difference is not just theoretical; it's proven by data. The top medical billing companies achieve results that in-house teams simply cannot match.

The Performance Gap:

Denial Rate: In-House (10-15%) vs. Outsourced (< 5%)

Days in A/R: In-House (45-52 days) vs. Outsourced (< 35 days)

First-Pass Payment Rate: In-House (~70-80%) vs. Outsourced (> 95%)

This isn't just "better billing." This is a direct, predictable increase in your monthly cash flow.

Comparison: In-House vs. Outsourced

| Factor | In-House Billing | Outsourced RCM Partner (SMBC365) |

|---|---|---|

| Cost Structure | High, Fixed Overhead (Salaries, Benefits, Software) | Low, Variable Cost (% of collections) |

| Expertise | Limited to 1-2 employees' knowledge. | Full team of certified coders, billers, & compliance experts. |

| Cash Flow | Slow. Average 45+ Days in A/R. | Fast. Average < 35 Days in A/R. |

| Denials | High. Average 10-15% denial rate. | Low. Aggressively managed to < 5%. |

| Disruption | High Risk. Cash flow stops on vacation/turnover. | Zero Risk. Our team never calls in sick. |

| Focus | Your staff is pulled away from patients to manage billing. | Your team is 100% focused on patient care. |

Stop Guessing. See Your True Revenue Potential.

Stop letting revenue leak from your practice. You cannot fix problems you cannot see.

As one of the top medical billing companies in the US, SMBC365 is offering a 100% free, no-obligation Revenue Recovery Analysis for qualified US practices.

Let our experts perform a comprehensive billing audit on your current accounts. We will show you exactly where you are losing money, how much revenue you're missing, and how our team can recover it for you.

Don't wait. Take control of your revenue today.

Get My Free Revenue Recovery Analysis Now at

https://smbc365.com/contact.php

Frequently Asked Questions (FAQ)

1. Is outsourcing medical billing actually more cost-effective than in-house billing?

Yes — and the savings are significant. In-house teams require salaries, benefits, software, training, HR management, and IT support. When you outsource to a professional RCM partner like SMBC365 (https://smbc365.com/medical-billing.php), you only pay a small percentage of what is successfully collected, turning a high fixed cost into a smart, variable one.

2. Will I still maintain control over my financial data if I outsource?

Absolutely. Outsourcing increases visibility, not reduces it. SMBC365 provides real-time reporting dashboards, weekly performance summaries, denial insights, and full claim lifecycle tracking. Instead of guessing, you gain crystal-clear visibility into your revenue cycle.

3. How do outsourced billing companies reduce denial rates so effectively?

Top RCM teams use a combination of:

Certified specialty coders

Automated claim scrubbing

Dedicated denial recovery teams

Continuous payer rule updates

Internal QA and auditing systems

This multi-layer approach is why SMBC365 keeps client denial rates below 5%, compared to in-house averages of 10–20%.

4. How fast can outsourcing improve my cash flow?

Most practices experience:

Faster reimbursements within 30–45 days

Reduction in A/R days by 10–20 days

Immediate decline in denials

Higher first-pass payment rates (>95%)

The improvement is fast because outsourced RCM teams work your claims daily, not occasionally.

5. Is outsourcing medical billing HIPAA compliant and secure?

Yes. SMBC365 follows strict HIPAA, HITECH, and CMS compliance standards, uses encrypted communication, secure servers, and multi-step data protection protocols. Your PHI remains protected at every stage.

6. Can outsourced billing companies also handle medical credentialing?

Yes. SMBC365 provides full medical credentialing services, including:

Provider enrollment

Payer contracting

CAQH setup/maintenance

NPI registration

Revalidations

Enrollment follow-up

Learn more: https://smbc365.com/credentialing.php

7. What is included in the free Revenue Recovery Analysis?

Your free analysis includes:

Complete billing audit

A/R and denial pattern breakdown

Revenue leakage identification

Compliance & coding review

Exact calculation of recoverable revenue

A personalized financial improvement roadmap

Request it here: https://smbc365.com/contact.php

8. How do I know if my practice truly needs to outsource?

Outsourcing is ideal if your practice is experiencing:

? High denial rates

? Slow payments or long A/R cycles

? Billing errors or missing charges

? Staff burnout or turnover

? Unpredictable cash flow

? Lack of coding expertise

? Poor transparency or reporting

If any of these sound familiar, outsourcing could dramatically improve your collections.

9. Does outsourcing eliminate the risk of billing delays?

Yes. With an outsourced RCM team like SMBC365, your billing never stops — even during:

Staff vacations

Sick leaves

Resignations

Office closures

Holidays

Your revenue flow stays uninterrupted, every single day.

10. What specialties does SMBC365 support?

SMBC365 supports nearly all major medical specialties, including:

Primary Care

Internal Medicine

Cardiology

Dermatology

Neurology

Psychiatry

Orthopedics

Gastroenterology

Pain Management

Radiology

Hospital/Facility Billing